You’ve worked hard for every dollar you’ve put into your investment properties. So why let taxes take a big bite out of your profits?

Whether you’ve flipped homes, held rentals, or built a solid portfolio over time, the goal is the same: grow your wealth, not hand it over to the IRS. That’s where the power of the 1031 Exchange comes in. It’s not just a tax deferral tool: It’s a smart strategy for scaling your investments without sacrificing your gains.

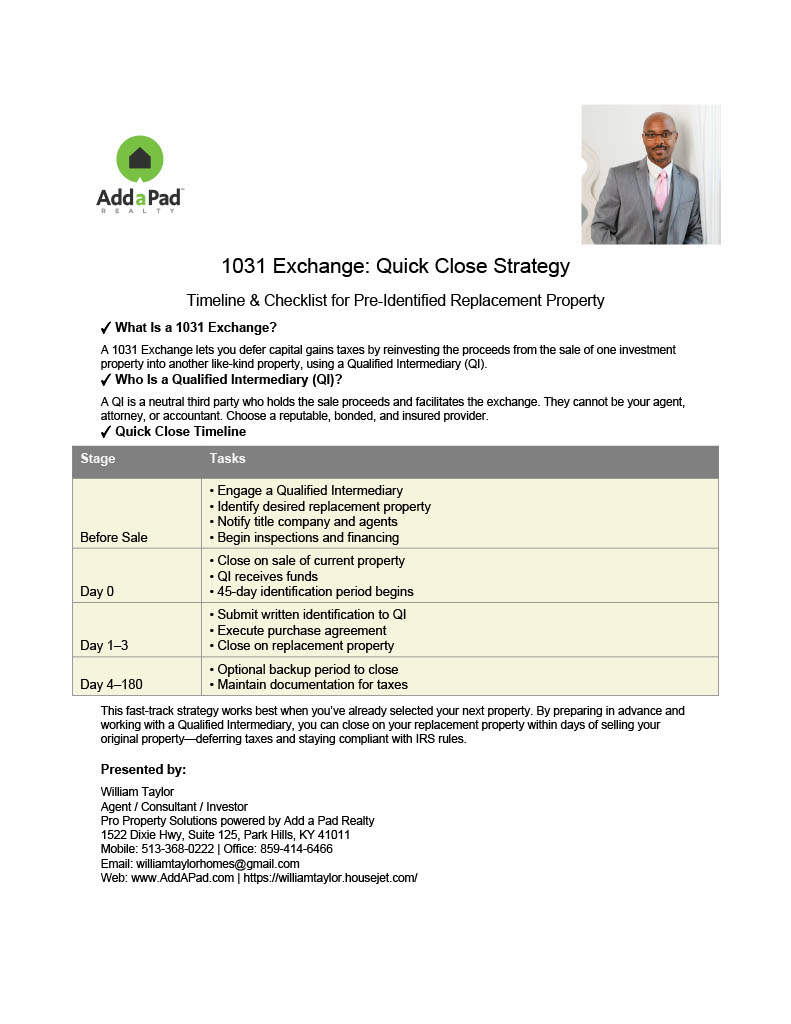

In this post, we’ll walk you through how to use the Quick Close Strategy to sell one property and reinvest into another — fast. By getting everything lined up before your sale, you can close on your next property in just days, avoid unnecessary delays, and keep more of the equity you’ve earned working for you.

If you're serious about building long-term wealth and want to make every move count, this strategy is for you.

🔁 What Is a 1031 Exchange?

A 1031 Exchange allows you to sell your investment property and defer paying capital gains taxes by reinvesting into another like-kind property. To stay IRS-compliant, the funds must be held by a Qualified Intermediary, not by you. Once your property sells, you have 45 days to identify a new property and 180 days to close.

Because many investors like you have already found your next property, you can use a fast-track approach. When you work with my team, we'll get everything lined up before you close on the sale — your intermediary, inspections, and financing. That way, we can close on the replacement property in just a few days after your sale, helping you lock in a great deal and keep the process smooth.

🧑💼 Who Is a Qualified Intermediary (QI)?

A Qualified Intermediary (QI) is a neutral third party who:

-

Receives and holds proceeds from the sale of your relinquished property.

-

Prepares exchange documents.

-

Ensures compliance with IRS rules (no constructive receipt of funds).

-

Transfers funds to purchase your replacement property.

✅ QIs Must Be:

-

Independent (cannot be your agent, employee, attorney, accountant, etc.).

-

Bonded and insured.

-

Experienced in 1031 transactions.

🔍 Examples of Reputable National QIs:

-

IPX1031 (Investment Property Exchange Services)

-

Asset Preservation, Inc.

-

First American Exchange Company

-

1031 Corp

-

Accruit

Your title company may also partner with a local or national QI.

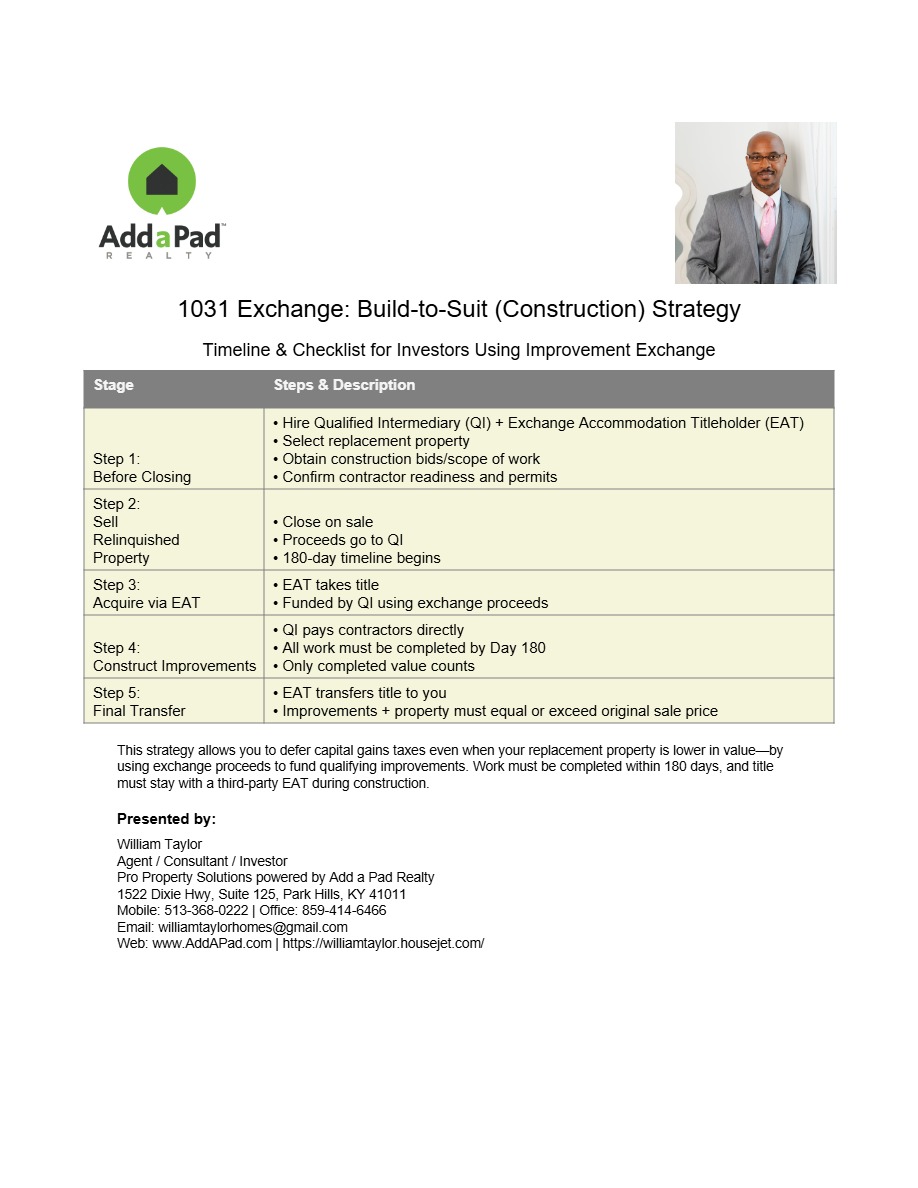

There are several strategies, depending on your particular circumstance, for executing a 1031 Exchange including; Pre-Identified Replacement Property Exchange, Build-to-Suit Exchange (construction/improvement), & Reverse Exchange (buy first, sell later). Toay we're focusing on the pre-identified replacement property option which is perfect for investors who operate at scale.

🗂️ Summary: Pre-Identified Replacement Property — Quick Close Strategy

This strategy is best when:

-

The investor already knows the property they want to buy.

-

They want to close quickly after selling their current property.

-

They are ready to act fast with financing, inspections, and due diligence pre-arranged.

✅ 1031 Exchange Timeline & Checklist: Quick Close Strategy

🟢 BEFORE SELLING (Preparation Phase)

| Task | Description |

|---|---|

| ✅ Engage a Qualified Intermediary | Interview QIs, sign exchange agreement. |

| ✅ Identify desired replacement property | LOI or contingent offer can be signed before sale. |

| ✅ Notify real estate agents and title company | Let them know this is a 1031 exchange. |

| ✅ Begin inspections and financing (if needed) | Line up mortgage or funds in advance. |

📅 DAY 0 – Sell Relinquished Property

| Task | Description |

|---|---|

| ✅ Close on the sale of current investment property | QI receives funds directly from the title company. |

| ✅ 45-Day ID Period begins | Starts the day after closing. |

📅 DAY 1–3 – Identification and Purchase

| Task | Description |

|---|---|

| ✅ Submit written identification to QI | Use the 3-property rule or 200% rule. |

| ✅ Execute purchase agreement for replacement property | If not already signed. |

| ✅ Close on replacement property | As soon as inspections, title, and funding are cleared. |

📅 DAY 4–180 – Optional Buffer Time

| Task | Description |

|---|---|

| ✅ Final window to close on any other identified properties | Only needed if original deal falls through. |

| ✅ Keep documentation organized | For CPA/tax filings and audit trail. |

Following these steps will ensure you have a smooth exchange and potentially save thousands of dollars in the process.

🚀 Thinking of selling an investment property?

Let’s map out your 1031 Exchange game plan before your next sale. My team and I will connect you with vetted QIs, trusted lenders, and help you position your next move for success.

Contact us to get started we’ll walk you through your next best step.